Budgeting

Budgeting is necessary to ensure you have enough money to meet your expenses, save up and plan for the future. We’ve got the best sources to help you learn along the way.

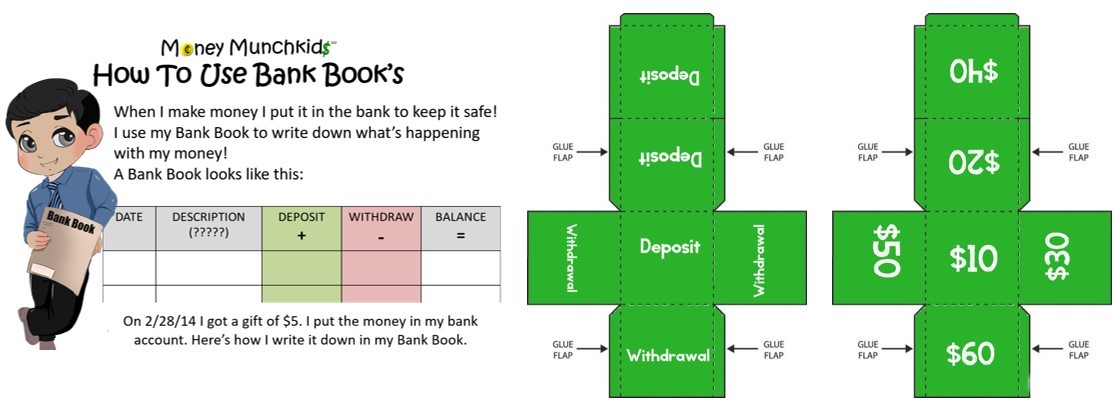

A budget is a plan to save or spend your money. – Money Munchkids definition

6 Steps to a Simple Budget

No matter how much you earn, you can still land deep into debt. With credit cards, online shopping, and free delivery it can get hard to control your spending. Whatever you think of, is only a press of a button away. Quite magical; I might say; only if it was free!!

How to fix your finances using the Envelope System

Are you struggling to stick to your budget and tend to overspend despite the budgeting apps on your phone? Do you just need a simple system to save up for a vacation or pay off that debt? Then the envelope system might be exactly what you need.

4 Basic Concepts to teach a kid Budgeting

When my son, Adam, was 5 years old, he was a constant nagger. Every-time we went shopping, he would ask me to buy something for him. Based on my previous decision to enlist my kids in their own upbringing and give them the opportunity to take control of their actions early on.

External Sources

Money Munchkids is not affiliated with, does not benefit from promoting and does not endorse any of the website or companies listed below. We have placed them here purely for educational purposes.

How to Create Budget for Student Loans

Creating a budget may sound complicated, but all you need to do to get started is set aside some time and get organized—the benefits will make the effort worthwhile. The following steps will help you set up your budget and manage your finances by helping you track your income and expenses.

The 50/20/30 Rule for Minimalist Budgeting

Budgets are more than just paying your bills on time—a budget is also about determining how much you should be spending, and on what. The 50/20/30 rule, also called the 50/30/20 budget, is a proportional guideline that can help you keep your spending in alignment with your savings goals.

10 Budgeting Mistakes You May Be Making

One of the reasons that many people give up on budgeting is that they can’t seem to make their budget work. Often the difficulties come from making one of these 10 common budgeting mistakes. Learn if you are making any of these mistakes and how you can fix them.

How to Create a Budget With a Credit Card

In the world of personal finance, it’s not very often that you hear “credit card” and “budget” used in the same sentence. As a credit card rewards enthusiast and zero-sum budget expert, people are constantly asking me how I reconcile those two opposite areas of interest.

How to Teach Kids Budgeting Habits Early On

Teaching your kids early to work within a budget pays off big for them down the road. Even when very young, kids are ready for the basic idea and as they get older, including them in your own budget planning helps them develop good habits from the start.

5 Steps to Buying a Home Within Budget

It’s easy to feel overwhelmed by all the decisions that go into buying a new home. But one question holds the key to home-buying success: how much home can you afford? Here are five steps to buying a home Dave Ramsey recommends to make the process smoother.

Mobile Apps

Money Munchkids is not affiliated with, does not benefit from promoting and does not endorse any of the website or companies listed below. We have placed them here purely for educational purposes.

Mint

Mint is one of the simplest budgeting tools which syncs with your credit and debit card transactions and creates a customized budget. Among many of its interesting features, it tracks your spendings and sends alerts on bills, payments and unusual spending.

PocketGuard

Specifically targeted to control spending, this app syncs all financial accounts and suggests ways to lower the bills and expenses. Providing investment options, interest rates and money-saving guidelines, Pocket Guard is ideal for people with a tight budget.

Books

Money Munchkids does not have an official partnership with any of the brands, authors or publishers below. Money Munchkids retains the right to utilize an affiliate link.

Books for Kids

Do I Need It? or Do I Want It?: Making Budget Choices

Do you plan how much money you’ll use to buy candy? Or how much you’ll save for a new video game? Then you’re budgeting! A budget is a plan for spending and saving. Budgets help people decide how to use their money wisely.

Books for Adults

Budget Planner Organizer Monthly

Get your finance in order with this Budget Planner. Include monthly budget and expense so you can easily keep track of your money. Start off on the right track and simplify your life and your bills.

Home Budget Workbook

Dread the sound of the ”B” word — budget? This easy-to-use journal and planner is for you! This journal will help you take control of your money by tracking your income and expenses.

Amazon: Financial Literacy for Kids

Buy top reviewed books from Amazon to help your kids through their journey of financial education. We believe that the lessons learnt hold way more value than the price of these books.

Amazon: Financial Literacy for Adults

These books cover various topics, including budgeting, for parents, millennials and college students. Here you can find books at every level for good understanding.

/Mint-5a8dd011642dca00367a3a37.png)

/PocketGuard-5a8dd065119fa80037ad96b5.png)