About Out Financial Education Kids Course / Camp

Our financial education program is offered in two formats, an after-school enrichment course and specialty camp, and takes children in grades K-3rd on an interactive educational adventure to understanding financial literacy and money management.

Through dynamic, teacher approved, hands-on lessons, children 5 to 9 years old will learn new vocabulary and financial education concepts such as those related to banking, saving, distinguishing needs vs wants, budgeting, even earning and investing money. Our financial education program also teaches kids other important life skills such as critical thinking, teamwork, leadership, and decision making.

Our program is led by a Money Munchkids® certified teacher who has been trained on the Money Munchkids® financial education program curriculum. The curriculum for our financial education program supports both national and international standards such as Core Curriculum Standards, McREL International Standards, Jump$tart Coalition for Financial Literacy Standards, TESOL International Language Standards and the National Association of State Administrators of Family and Consumer Sciences Standards.

The Money Munchkids financial education program is designed to meet the learning styles of all students. Every lesson incorporates a combination of learning styles (visual, aural, verbal, kinesthetic, logical, interpersonal and solitary) to teach the content to all learners. Our classes include lectures, stories, musical expression, partner work, independent exploration, kinesthetic activities, group activities, and interactive dialogue to support learning.

Our take-home materials bridge class learning with home conversations and real-life scenarios.

Course Length: 8 one hour lessons spread across 1-8 weeks

Age/Grade: 5-9 years old / K-3rd Grade

Fee: Approximate fee for the 8-hour financial education course is between $100-$250 and can vary greatly based on location.

Special group rates available on our financial literacy course! Discounted rate available for Girl Scouts, Boy Scouts, Girls & Boys Club and homeschool groups!

Your Child Will Learn About:

Our financial education course covers a variety of topics. Many of our topics are covered multiple times, in various ways and in conjunction with one another to better teach children how various financial concepts work together. Below we’ve several basic topics our course covers.

- Units of Currency

- About Banks

- Investing & Interest

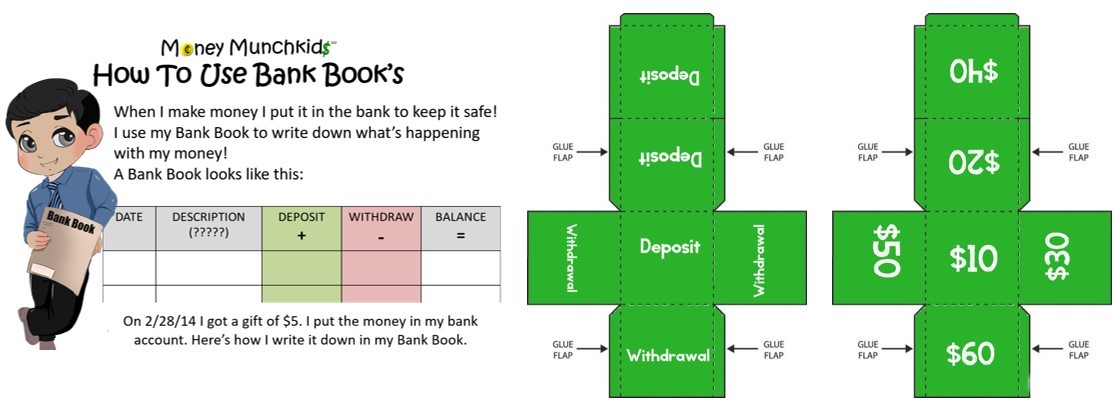

- Deposits / Withdrawals

- Needs vs. Wants

- Saving & Charity

- Making Personal and Financial Goals

- Income / Expenses / Profit

- Opportunity Cost

- Credit Cards vs. Debit Cards

- What Is Debt

- How to Budget

- Ways & Ideas on How to Earn Money

The Course Includes:

Our program includes lots of amazing lots of interactive activities, group discussions, games and more. Here is a list of just a few things the course includes:

- 8 hours of Instruction

- Lots of In-Class Activities

- 12 Activity Sheets

- Money Munchkids Bank Book

- Vocabulary Sheets

- Money Smart Poster

- Money Munchkids Activity Set

- Customized Certificate of Completion

- Website Activity Sheet Access Link

- Resource List for Parents and Kids

- Over $30 of prizes per Child

- Recommended Reading List

Lesson Plan:

Lesson 1: Introduction to Money

Lesson 2: All About Banks

Lesson 3: Needs vs Wants / Save vs Spend

Lesson 4: Credit Cards & Review

Lesson 5: Income, Expenses, Investing

Lesson 6: Opportunity Cost & Budgeting

Lesson 7: It All Works Together!

Lesson 8: Money Games & Graduation!

Class Structure:

60 Minute Classes:

Arrival/Class Start: 5 mintues

Lesson Plan: 45 minutes

Class Store: 10 minutes

Class End/Pick-up