IMPORTANT:

Due to supply chain issues we are experiencing a supply shortage from our printers which has caused a

backorder/fulfillment backlog. We appreciate your patience and support as we try our best to serve you while

dealing with the effects on the supply chain due to covid-19. Thank you for your support & patience. ~ Victoria, CEO

Education At Home

At Money

a variety of products for parents to use at home to help their children learn money management

and financial education. Our home education products are secular and made for all learning styles.

Our Products Include:

- Financial Education Curriculum

- Financial Education Games

- Digital Activity Books

- Financial Educational Accessories

- and more!

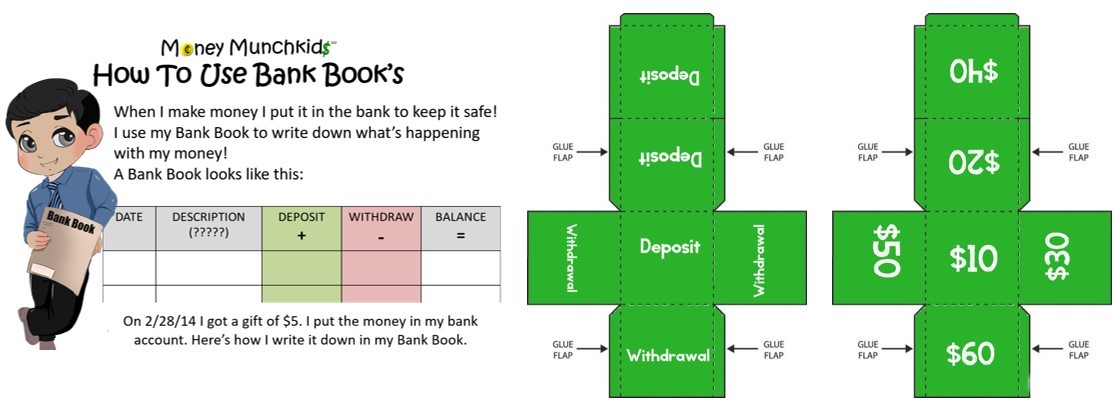

Logan is 7 years old, loves banks and keeping track of his money!

Sam is 8 years old and thinks its so cool how there are so many ways to use money!

Free Resources & Podcast

We want to help everyone learn about money and all things related to making good financial decisions.

Keeping this goal in mind we’ve created our financial education directory which you can find articles, videos and other helpful resources.We also have the Money Munchkids podcast where we talk about:

- all things money

- ways to make money as kids and as adults

- career deep dives

- featuring amazing kids and child authors

- educational companies

- financial education topics

- family and homeschooling tips & tales

- financial education resources and books and much more!

We’re always looking for guest speakers. Click the “Be On Our Podcast” button below to get a chance to tell your story!

Classroom Curriculum

The Money Munchkids Classroom Curriculum for Financial Education was created to fill the current financial education void that exists in our schools today. Our curriculum is comprised of 35 key lessons, roughly 40-50 minutes each, that are designed to be taught once a week. We have also included four supplemental lessons to allow for the variations between educational institutions total school weeks.

Our curriculum starts where most schools, and Common Core, leave off; at identifying and counting money. This allows for seamless inclusion into any classroom. From there our curriculum goes on to a wide variety of money-related topics such as the history of money, bartering, income, expenses, needs vs wants, banks, debit vs credit cards, budgeting, compromise, supply and demand, investing, charity and how all of these concepts work together on an everyday basis.

Our curriculum was created with the assistance of several teachers across the globe. We have worked tirelessly to ensure it is both easy to use for the teachers as well as engaging for students. Our curriculum was designed to cater to young children by utilizing all seven learning styles. Our expert education consultants assisted in ensuring easy integration for any educational institution including those with multi-grade classrooms.

Ben loves to learn about new ways to earn money.

Subscribe To Our Newsletter

Knowledge Center

Be the Change in Financial Literacy

Throughout the years, whether it’s in Kindergarten, High School, College, or as an adult, we often look back at our toughest experiences. Many of those tough experiences have one thing in common: money (or financial literacy). When faced with these kinds of tough...

Smart Money Smart Kids Review

Let’s face it, a good majority of us could use a financial wake-up call now and then! This readers review on Smart Money, Smart Kids by Dave Ramsey discusses the sage advice, tough love, charming Tennessee humor, and family anecdotes this book is filled with.

We’re starting a podcast!

Money Munchkids is starting a podcast and we'd love to feature you! We're all about creating a community of financially prepared people, especially kids so we're looking for both adults and kids who would love to help make this podcast a "priceless" experience! Just...